How to Use Your Manufacturing Business Funds

A Manufacturing Business Loan from Expansion Capital Group can help your small business keep up with production demands, invest in efficiency, and fuel future growth. Access to fast, flexible capital allows manufacturers to take advantage of new opportunities—whether that means upgrading equipment, managing cash flow, or expanding operations.

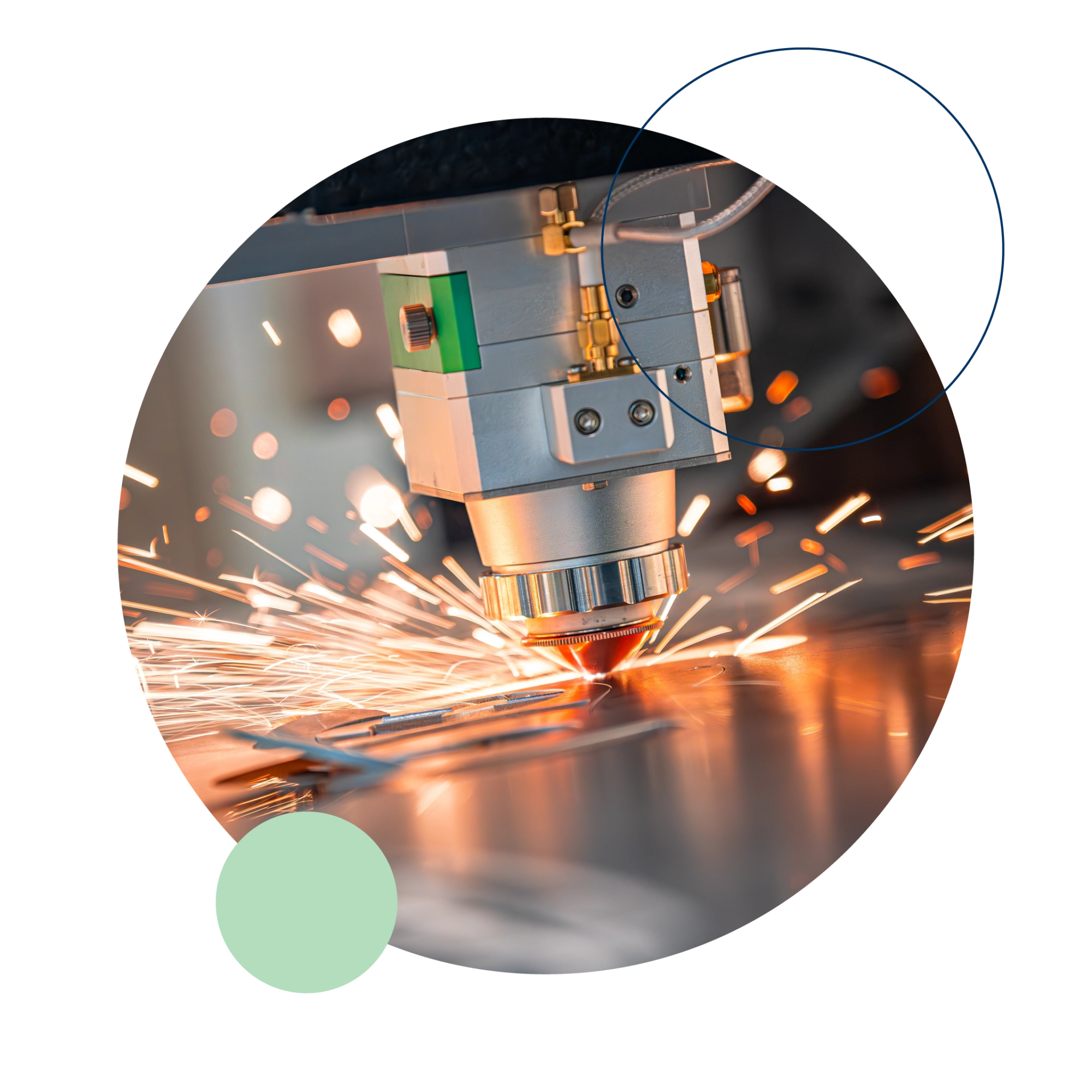

With additional funding, you can modernize your machinery and technology to improve speed, consistency, and product quality. Investing in the right equipment not only boosts productivity but also helps lower long-term costs and keep you ahead of competitors.

Manufacturing loans can also help you stabilize cash flow by covering payroll, maintenance, or raw material costs during busy seasons or unexpected slowdowns. This ensures your business keeps running smoothly—no matter what the market brings.

Whether you’re looking to expand your facility, take on larger contracts, or strengthen your supply chain, a Manufacturing Business Loan from ECG gives you the working capital you need to keep production moving and business growing.